| StockFetcher Forums · Stock Picks and Trading · Pattern Watching | << 1 ... 12 13 14 15 16 ... 20 >>Post Follow-up |

| styliten 329 posts msg #159119 - Ignore styliten modified |

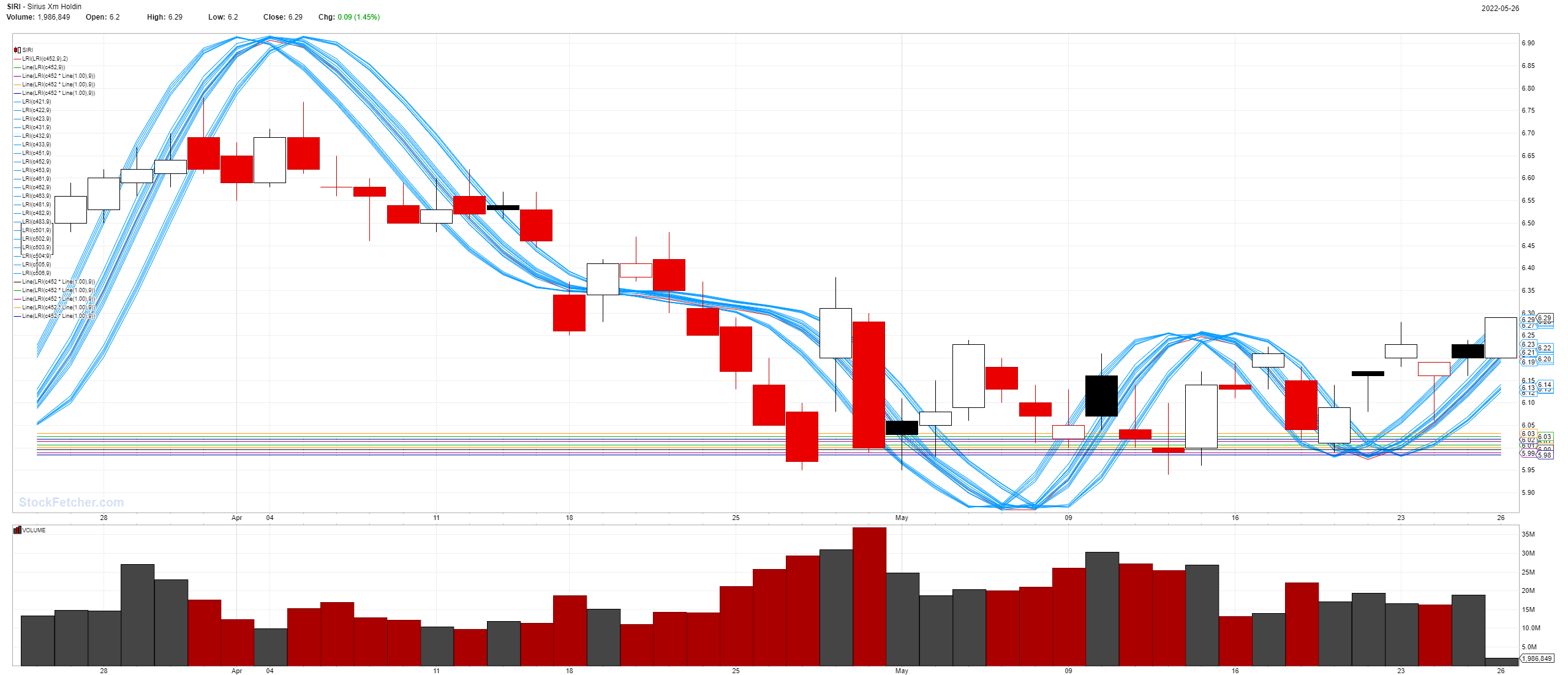

5/26/2022 10:40:22 AM @ Nobody SIRI looks very strong:  And also CHWY:  |

| Nobody 404 posts msg #159120 - Ignore Nobody |

5/26/2022 11:36:39 AM Boss styliten Thanks -- CHWY looks nice...looking at its short float% on finviz... you see that what does option chain say? Chewy, Inc., together with its subsidiaries, engages in the pure play e-commerce business in the United States. The company provides pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services for dogs, cats, fish, birds, small pets, horses, and reptiles through its www.chewy.com retail Website, as well as its mobile applications. It offers approximately 100,000 products from 3,000 partner brands. The company was founded in 2010 and is headquartered in Dania Beach, Florida. |

| Nobody 404 posts msg #159121 - Ignore Nobody |

5/26/2022 11:45:01 AM Disclaimer: I don't know anything CHWY - Upside quick hit and run $28-$30 Downside $24ish |

| styliten 329 posts msg #159122 - Ignore styliten modified |

5/26/2022 11:46:01 AM @ Nobody, Quitted doing options a few years back--never had any good intraday timing mechanism for entering or exiting options! Basically 100% on the long side only. Many consumer discretionary stocks are coming back to life in the last few days: GE, GM, TSLA, GT, HOG, RIVN, WW, COST, WMT, DG, BBY, BBWI, BBY, CUK, NCLH, RCL, CCL, MAR, HLT, CSX, BYND, GLW, EBAY, INTC, QCOM, SIRI, AAL, UAL, DAL, SAVE, AZUL, LUV, ULCC, FDX, etc., etc. and MANY banking financial services stocks as well, not to mention oil stocks! |

| Nobody 404 posts msg #159124 - Ignore Nobody modified |

5/26/2022 4:14:41 PM Hi styliten Never played options in my life. I do look at them as a form of indication trying to mix-up all fundamentals and technicals to make decisions. My job doesn't allow me to day trade so mainly med-long term stuff. Just a woookie here :) |

| styliten 329 posts msg #159127 - Ignore styliten modified |

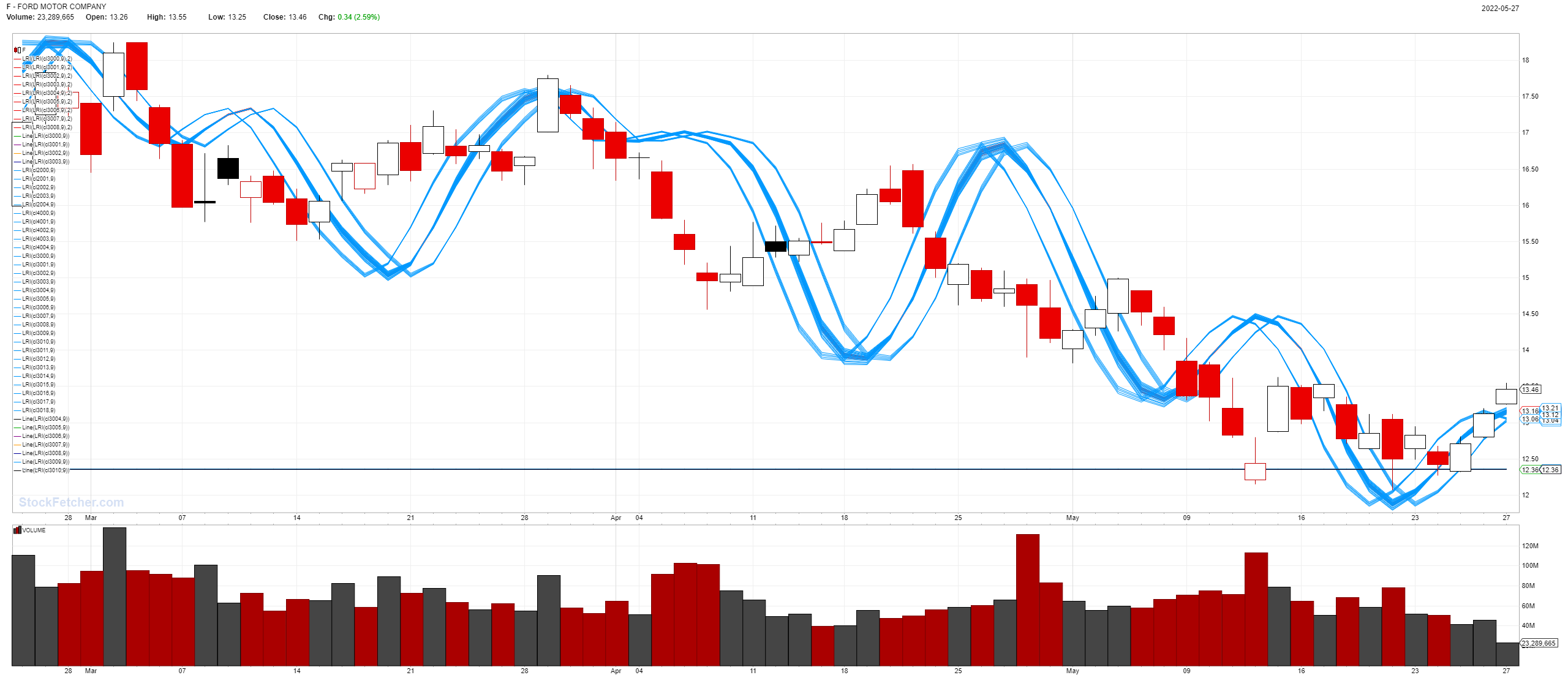

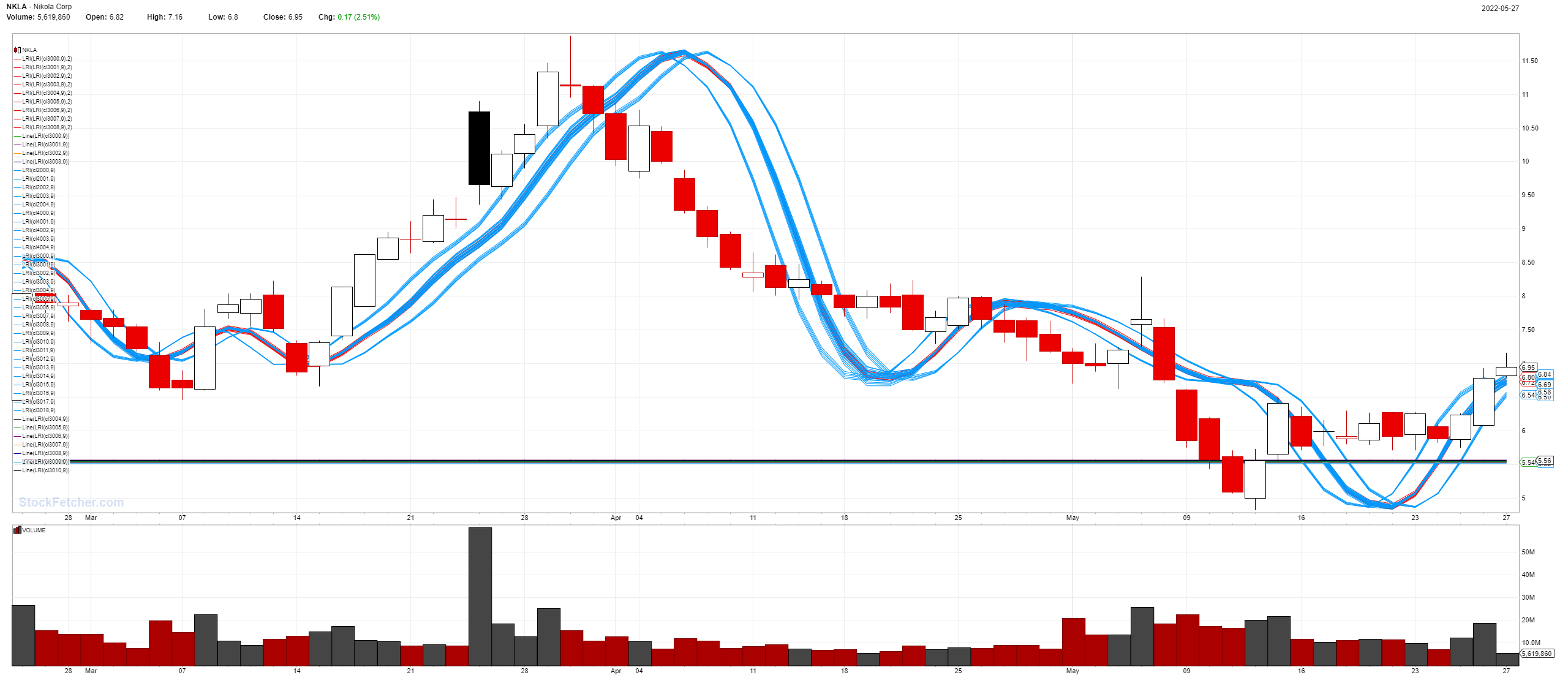

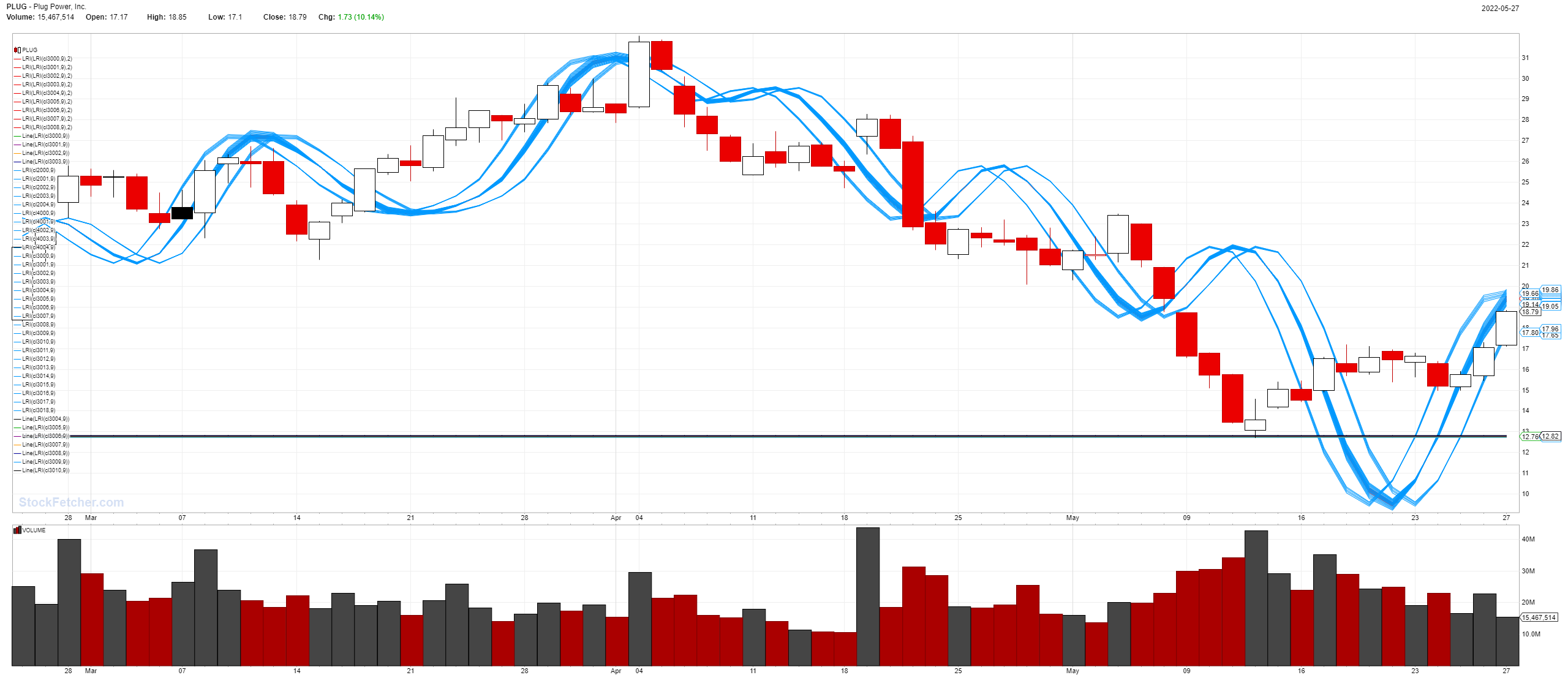

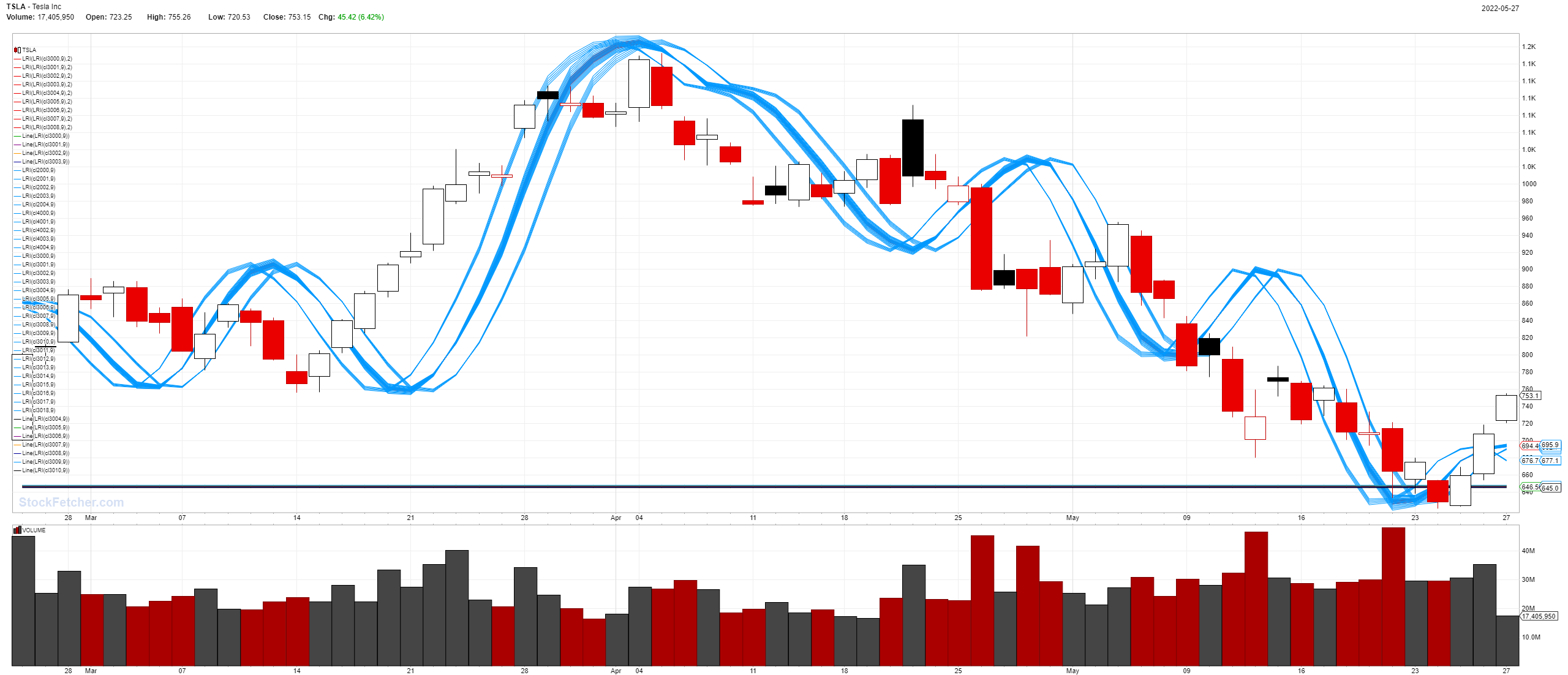

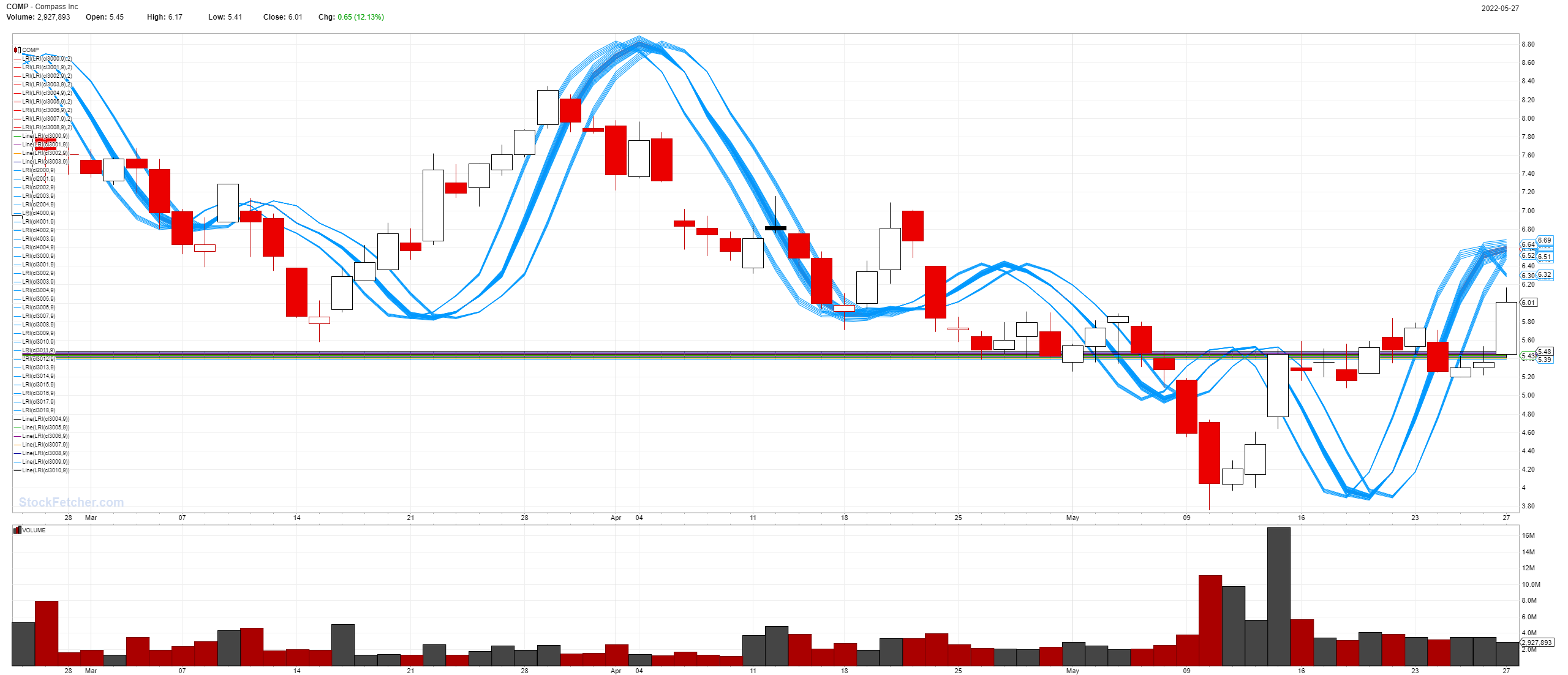

5/27/2022 12:26:29 PM F:  NKLA:  PLUG:  BYND:  TSLA:  COMP:  |

| Nobody 404 posts msg #159140 - Ignore Nobody |

5/30/2022 4:37:51 PM styliten Trust you enjoying long weekend. |

| styliten 329 posts msg #159143 - Ignore styliten |

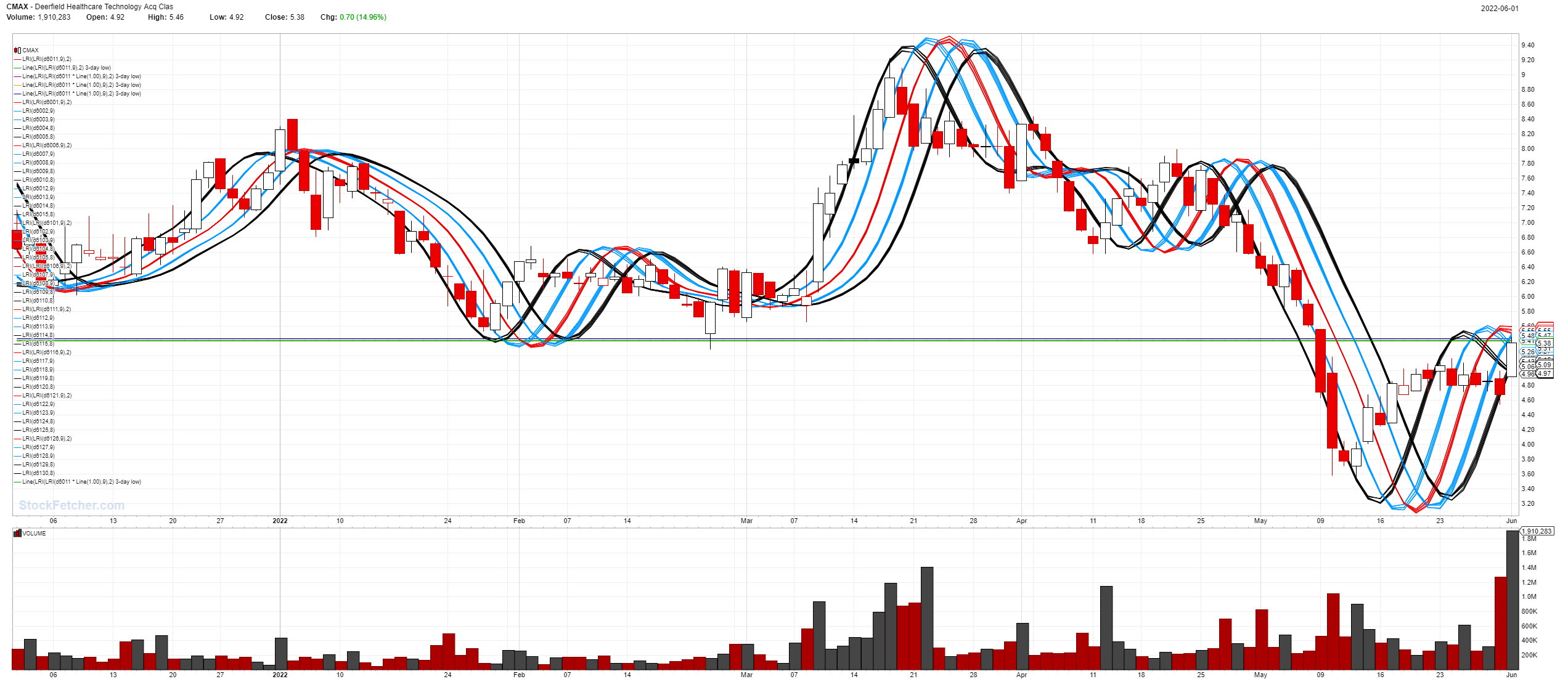

6/1/2022 2:18:33 PM @ Nobody, Which would you pick today, from the following 4? 1. AVYA:  2. GTYH:  3. VAXX:  4. CMAX:  |

| Nobody 404 posts msg #159144 - Ignore Nobody |

6/1/2022 3:40:45 PM styliten Boss you put this rookie on spot... hmm 1) AVYA - our firm uses the product Short Float 10% per FINVIZ Avaya Holdings Corp., through its subsidiaries, provides digital communications products, solutions, and services for businesses worldwide. The company operates in two segments, Products & Solutions and Services. The Products & Solutions segment offers unified communications and collaboration (UCC), and contact center (CC) platforms, applications, and devices. It also provides Avaya OneCloud UCaaS solutions that enables organizations to provide their workers with a single application for all-channel calling, messaging, meetings, and team collaboration with the same use as existing consumer apps; and Avaya OneCloud CCaaS solutions, which enables customers to build a customized portfolio of applications driving customer engagement and customer value, as well as offers communications solutions include voice, email, chat, social media, video, performance management, and third-party integration. This segments Avaya OneCloud CPaaS solutions combines the cloud with its communications platforms, which enables developers to integrate both UCC and CC communications capabilities directly into internal and customer-facing applications and workflows. The Services segment provides global support services, enterprise cloud and managed services, and professional services. The company also offers business devices, such as IP-enabled handsets, multimedia devices, and conferencing systems. It sells directly through its sales force, as well as indirectly through its network of channel partners, including distributors, service providers, dealers, value-added resellers, system integrators, and business partners. The company has a strategic collaboration with RingCentral, Inc. to accelerate the company's transition to the cloud. Avaya Holdings Corp. is headquartered in Durham, North Carolina. 2) VAXX Vaxxinity, Inc., a biotechnology company, focuses on developing product candidates for human use in the fields of neurology and coronaviruses in the United States. The company engages in developing UB-311 that targets toxic forms of aggregated amyloid-b in the brain to fight Alzheimer's disease (AD) that is in phase 2 clinical trial; UB-312 that targets toxic forms of aggregated a-synuclein in the brain to fight Parkinson's disease and other synucleinopathies, such as Lewy body dementia and multiple system atrophy that is in phase 1 clinical trial; and an anti-tau product candidate for various neurodegenerative conditions, including AD. It is also developing UB-313 that targets calcitonin gene-related peptide to fight migraines; anti-PCSK9 that targets proprotein convertase subtilisin/kexin type 9 serine protease to lower low-density lipoprotein cholesterol and reduce the risk of cardiac events; and UB-612 for neutralizing the SARS-CoV-2 virus, which is in phase 3 clinical trial. Vaxxinity, Inc. was founded in 2014 and is headquartered in Dallas, Texas Disclaimer - I don't know anything! |

| Nobody 404 posts msg #159145 - Ignore Nobody |

6/1/2022 3:43:40 PM styliten How good is the FINVIZ insider buy information. I mean in terms of using to decide to buy / time trade? Your thoughts SEE HERE: https://finviz.com/insidertrading.ashx?tc=1 Thanks |

| StockFetcher Forums · Stock Picks and Trading · Pattern Watching | << 1 ... 12 13 14 15 16 ... 20 >>Post Follow-up |