| StockFetcher Forums · Stock Picks and Trading · Generic | << 1 ... 4 5 6 7 8 ... 63 >>Post Follow-up |

| four 5,087 posts msg #120997 - Ignore four |

7/10/2014 1:03:18 PM SO @ $44.46 |

| johnpaulca 12,036 posts msg #120998 - Ignore johnpaulca |

7/10/2014 1:11:19 PM cup and handle? |

| four 5,087 posts msg #120999 - Ignore four modified |

7/10/2014 1:29:37 PM JP 1. liked the dividend 2. used filter posted below 3. ema33 > ema55 4. low touched ema33 and closed above |

| four 5,087 posts msg #121018 - Ignore four modified |

7/14/2014 11:57:30 PM  |

| four 5,087 posts msg #121064 - Ignore four |

7/22/2014 1:50:19 PM |

| four 5,087 posts msg #121102 - Ignore four |

7/25/2014 10:35:34 PM http://www.opensecrets.org/pfds/recent_trans.php |

| four 5,087 posts msg #121105 - Ignore four |

7/26/2014 11:21:18 AM http://www.marketwatch.com/story/buy-and-hold-is-impossible-2014-07-25?siteid=yhoof2 |

| novacane32000 331 posts msg #121122 - Ignore novacane32000 |

7/27/2014 5:15:40 PM Four Do you have a favorite filter for going long-short? |

| four 5,087 posts msg #121123 - Ignore four modified |

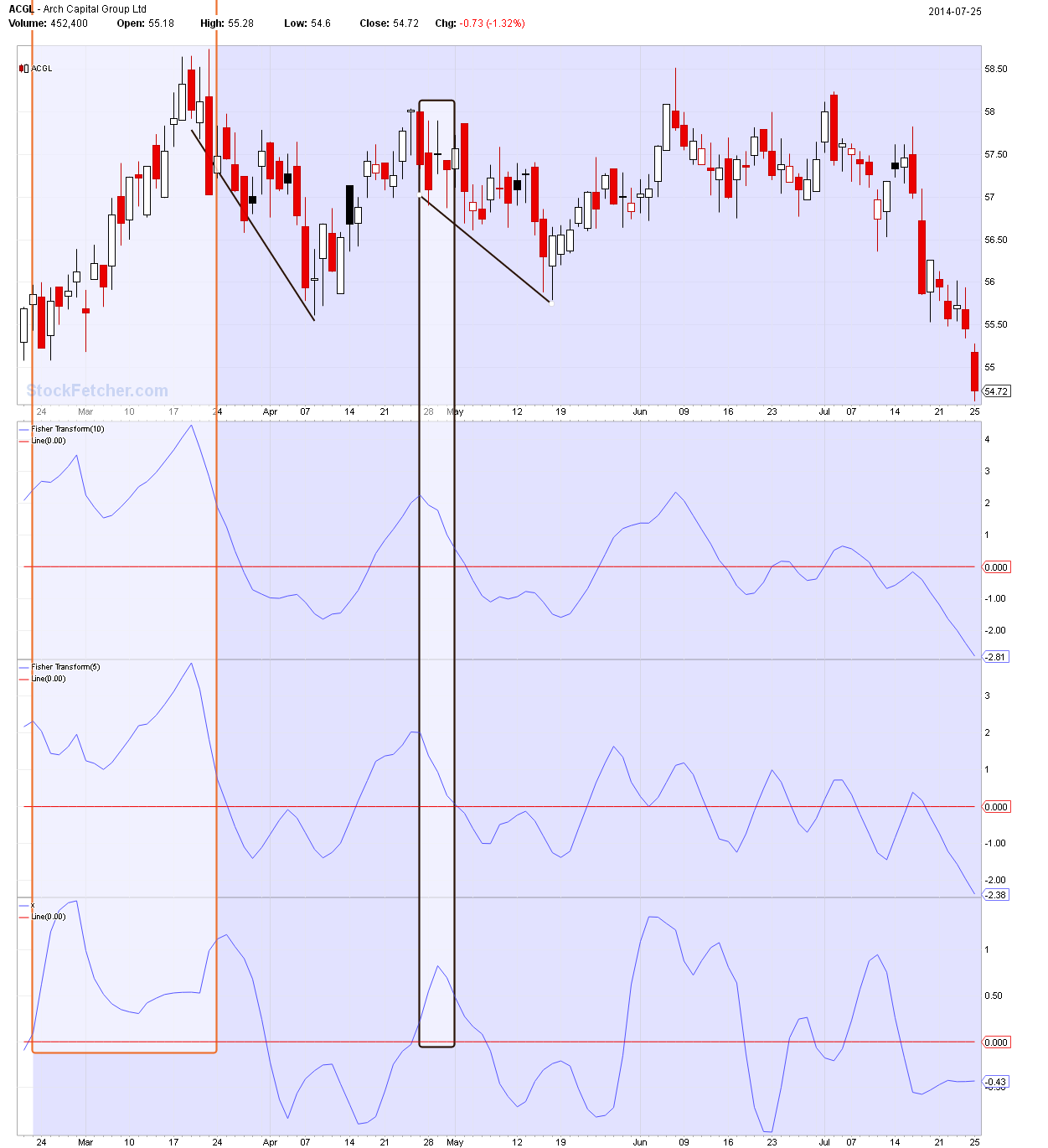

7/27/2014 6:19:00 PM novacane32000, No favorite for long/short. I rarely short. I don't go short unless it pays no dividend. I don't go long unless it pays a dividend. I stay away from OTC. Low > 10. Decent volume. I look for a dip in the short trend while the long trend is keeping the momentum (opposite for short). I enter at the trigger day price (high=long,low=short) or better, next day, with a stop-limit. I exit with a limit. I also find that I will keep setting new trades if the stock is going down (new order based on the new high each day--if long) until it executes. This seems to keep me out of many stocks that react poorly to the filter. You will see a "trend" in the filters posted that reflect the above thesis.I keep my "bet" small (individual stock)) enough that a 50% drawdown doesn't hurt. The dividends keep pumping new money into the 'system. I always have trouble with the exit (win/loss). Perhaps, you can offer your favorites with the rules... or rework one of my posts into something. HTH Here is something you might play with for a short. i would test it visually by moving forward, hence the offset being 100 days. Again, you would keep resetting your order if the filter hits again. I would be interested in a filter that doesn't have to be reset. Does anyone here enter at the trigger and accept an immediate drawdown and exit for a loss? Or set a farther away stoploss and let the stock "meander" for a while? Average up? Average down? Pyramid in either direction? FIRST RECTANGLE: EXAMPLE OF WAITING A WHILE FOR THE SHORT TO BE LARGE AND RUNNING INTO MANY FALSE SIGNALE AND RESETTING THE ORDER Second Rectangle, on the other hand, went much better.  |

| four 5,087 posts msg #121229 - Ignore four |

8/1/2014 11:41:02 PM |

| StockFetcher Forums · Stock Picks and Trading · Generic | << 1 ... 4 5 6 7 8 ... 63 >>Post Follow-up |