| StockFetcher Forums · General Discussion · Best Time of Day for Stock or ETF Entry? | << 1 2 >>Post Follow-up |

| pthomas215 1,251 posts msg #134048 - Ignore pthomas215 |

2/4/2017 2:36:14 PM Im wondering if anyone has analyzed the best time to enter a trade during the day, whether it be a day or swing trade. sometimes I have noticed a 12 noon eastern lunch pull back dip but it may be a figment of my imagination. |

| graftonian 1,089 posts msg #134059 - Ignore graftonian |

2/5/2017 12:03:31 PM PT, If you figure this out, bottle it and sell it! While playing with the various "crockpot" variants, it is obvious that a good trade starts with a good entry. my early thoughts: Let the 15 minute EMA(13) guide you. If the price is below a descending EMA13, consider waiting till price closes above a rising EMA13. Rarely does this strategy result in an entry higher than the daily open, and this is offset by many favorable entry points, and sometime no buy at all. I have evolved a sell strategy that works something like this: 1. Sell 1/2 the position at 5%(or whatever) 2. Place sell stop at that point until 15 minute EMA(3) catches up. 3. At EOD, sell of place stop if strong runner. Duane |

| pthomas215 1,251 posts msg #134060 - Ignore pthomas215 |

2/5/2017 12:39:17 PM Thanks Duane. I do have the EMA (13) on my main chart, and I usually want price to at least be resting on it or below it. I appreciate your insight. |

| four 5,087 posts msg #134062 - Ignore four modified |

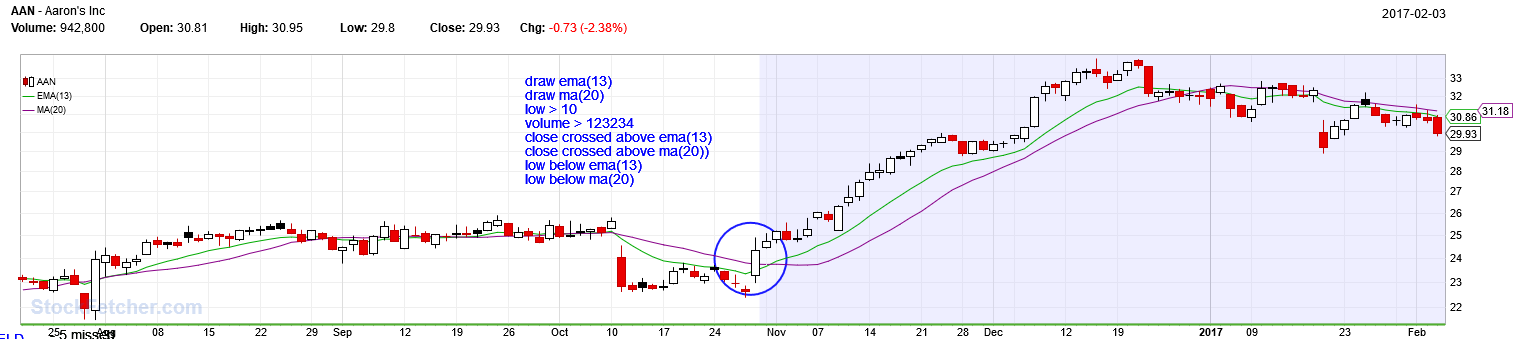

2/5/2017 1:45:54 PM http://greenonthescreen.blogspot.com/2007/03/filters-i-use.html "ones that have pulled back into what we refer to in the chat as the MZ (muddy zone).This is the zone of the ema13/sma20." http://www.stockfetcher.com/forums2/General-Discussion/Best-Time-of-Day-for-Stock-or-ETF-Entry/134048 "EMA(13) guide you" Thought I would play with EMA(13) since you both mention it. http://filteringwallstreet.blogspot.com/ Likes a crossover "4, 8 and 21 EMA" -- 4+8 is almost 13 AND 21 is almost 20 Here is the result...   |

| pthomas215 1,251 posts msg #134063 - Ignore pthomas215 |

2/5/2017 2:01:30 PM I think both you guys are smarter than the judge Trump just appointed to the supreme court. I get it Four, so you want the EMA 13 crossing up above the MA 20. i was initially thinking of intraday entry but this helps for the whole swing trade. what time from do you usually use to look at both indicators?? |

| four 5,087 posts msg #134065 - Ignore four modified |

2/5/2017 2:12:03 PM My coments in bold pthomas215 531 posts msg #134063 - Ignore pthomas215 2/5/2017 2:01:30 PM I think both you guys are smarter than the judge Trump just appointed to the supreme court. I get it Four, so you want the EMA 13 crossing up above the MA 20. i was initially thinking of intraday entry but this helps for the whole swing trade. Averages do not need to cross on this filter. CLOSE must cross above both Averages AND LOW remains below both Averages. close crossed above ema(13) close crossed above ma(20)) low below ema(13) low below ma(20) what time from do you usually use to look at both indicators?? Just built it "this moment" never been tested. I use StockFetcher , so I would try daily chart. Maybe stoplimit at high +.01 of trigger day?? |

| miketranz 978 posts msg #134066 - Ignore miketranz |

2/5/2017 3:27:34 PM Professional money controls the open and the close.Anything in between is for amateurs.... |

| pthomas215 1,251 posts msg #134067 - Ignore pthomas215 |

2/5/2017 4:20:58 PM four, thank you. so, say you are in a position on a stock that fits those parameters but you start to see some consolidation on it. what is your litmus test to decide whether to stay in the trade or exit completely? |

| four 5,087 posts msg #134068 - Ignore four |

2/5/2017 6:01:16 PM It has been many years and I still struggle with exit criteria. Perhaps the quote below helps? http://filteringwallstreet.blogspot.com/ "Exiting a cross over is up to you - I expect 3% to 5% and after that everything is golden. My stop is always just below the crossing bar because the beauty of the cross over is - it works or it doesn't. I use a close as a trigger to sell the stock. In other words an intra-day move below the candle will not cause me to sell but a end of day close below the candle definitely will. While some folks have studied it and think that a pull back is OK I prefer the ones that go straight up." -- |

| four 5,087 posts msg #134069 - Ignore four |

2/5/2017 6:11:56 PM I trade --99% of the time-- dividend stocks. I am willing to collect dividends... |

| StockFetcher Forums · General Discussion · Best Time of Day for Stock or ETF Entry? | << 1 2 >>Post Follow-up |